Land Loans: How to Do a Balance Sheet

We explain the why and how behind filling out a balance sheet when getting a land loan. Article includes a balance sheet template.

In this article you'll find:

- Why lenders ask for a balance sheet

- A balance sheet template

- Understanding assets, liabilities and equity ratio

How to do a Balance Sheet

So you’re getting a land loan, and your lender has asked you for a balance sheet (sometimes referred to as a personal financial statement). You go to fill it out and now you’re feeling a little overwhelmed.

Don’t worry! It’s not uncommon for the first time you’ve ever had to put all your financial information down on paper to be during the loan process. The terminology used on these forms can sometimes be difficult to understand. Most lenders will sit down with you and help you complete it. But you may want to give it a shot on your own or do a little research to better understand what you are being asked to do. This article is here to help!

Why Lenders Ask for a Balance Sheet

-

It gives your lender a true snapshot of your financial standing. That helps them make a better decision for you when moving forward with your loan. It shows them what you’re worth – which is more than just the cash you have sitting in the bank. And that paints a much better picture for justifying a loan. For example, you may have other debts, but if you’ve already paid on a significant portion of those principals, your bank can weigh them more as an asset and then use them in favor of justifying more debt.

-

It shows where your down payment is coming from. Seeing your cash-on-hand in savings or checking proves to your lender that you can make your payments. BUT including items such as real estate or equipment that you own may mean that your lender can help you use those assets as collateral to lower the cash down payment they require.

-

It strengthens the case for your repayment ability. Your lender can tell from a balance sheet how strong you are financially to be able to withstand some financial adversity. That gives them confidence that you are a good investment for a loan.

Providing this information up front allows your lender to find the best way to help you finance your purchase!

Click below to download a balance sheet template. Follow along with the rest of this article as you start to fill out the template.

Understanding the Balance Sheet

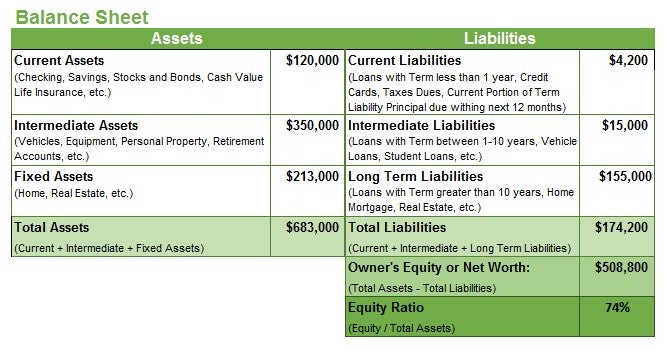

Lenders commonly utilize a balance sheet for a financial reference. A balance sheet is a “snapshot” of a borrower’s financial position and outlines an individual’s net worth. Net worth, or Equity, reflects the value or dollar amount of the reported assets you actually own, versus how much is currently financed.

Even if you aren’t requesting a loan, it’s a good idea to gauge your growth and financial position at a given point throughout the year and to keep this timing consistent from year to year. This should help you to determine both your personal and business financial position.

Assets

Assets are what you own. Some examples of assets are cash, real estate, vehicles, etc. They can be broken down into 3 categories:

-

Current Assets – Items that are readily available for use or for sale if needed in the next 12 months (ex. Cash on hand, savings, stocks, etc.)

-

Intermediate Assets – Items you own that typically have a 2-10 year life (ex. Vehicles, life insurance, personal property, etc.)

-

Fixed/Long Term Assets – Items you own that are permanent that typically have a >10-year life (ex. Home, real estate, etc.)

Liabilities

Liabilities are what you owe. Some examples of liabilities are credit card debt, mortgages, equipment, auto loans, etc. They can also be broken down into 3 categories:

-

Current Debts – These are debts to pay within 1 year (ex. Credit card, taxes, etc.)

-

Intermediate Term Debts – These are debts to pay in 1-10 years (ex. Vehicle loans)

-

Long Term Debts – These are debts to pay in more than 10 years (ex. Home mortgage, real estate)

Asset, Liability or Both?

Some items will fit on both sides of the balance sheet. For example, you own your home, so list the value as an asset ($200,000). However, you still have mortgage debt, so list the amount you still owe as a liability ($105,000).

When listing your assets, be sure to use a reasonable, current market value, not just the original purchase price. For example, if you purchased your home for $180,000 but current market value is $200,000, list the asset value as $200,000. If you still owe $105,000, that is the amount you should list as your liability.

A mistake many people make is NOT listing items they don’t own outright such as boats or vehicles. They should be listed on both sides – the value as an asset, and what is still owed as a liability. It is important to list everything so that the value of the portion you DO own is represented in your Net Worth and calculated in your Equity Ratio.

Equity Ratio

Net Worth gives the lender a dollar amount which is useful in determining how much a person is worth. But the Equity Ratio is especially important to a lender because it tells what percent of your assets you actually own. A high equity ratio means you own more of your assets than debts financed with other lenders. A lower equity ratio means you have more assets financed by other lenders than you have of your own cash in the asset. The lower the equity ratio, the higher the risk for a lender to finance additional debt.

Balance Sheet Example

Questions?

We hope this information is helpful in helping you complete your personal balance sheet. If you're looking for land in South Carolina or Georgia and have questions or would like additional help in completing your balance sheet, one of our loan officers would me more than happy to help. Find an AgSouth Branch near you!

Not in South Carolina or Georgia? Find your Farm Credit Association.