The Anatomy of a Credit Score: What Really Matters

The Anatomy of a Credit Score: What Really Matters

To a lender, your credit score is an indicator of your financial health. Different loan programs have different criteria for what credit scores are acceptable and you should discuss with your lender when shopping loan programs. Below we go over credit score factors, how much each factor attributes to your overall score, and tips you can use to ensure you have a healthy credit score for years to come.

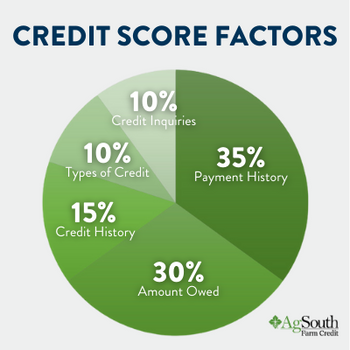

Payment History

35% - The most important factor of what makes us your credit score is your payment history. It’s so important to make sure your bills are paid on time each month. If your bills are 30 days late, that can damage your credit score, and the later you pay the greater the damage. You may want to consider setting up reminders or automatic methods to pay your monthly bills.

Credit Utilization or Amount Owed

30% - Part of your score is factored on how much you owe compared to how much credit you have available. Lenders want to see that you can use your available credit responsibly without burying yourself in debt. Maxing out your credit cards will have a negative impact on your credit scores. Most experts recommend keeping balances under 30% of your available credit.

Length of Credit History

15% - The longer your credit history, the better. Some potential borrowers think that closing unused credit cards is the best approach, when that may actually not be true. If your credit card has an annual fee, that may be a good idea, but in other cases it’s not always. You need to prove you are able to manage your credit over time because this helps show your future lending behavior. Not only is the average age of all of your accounts on your credit report looked at, but the age of the oldest account is also factored in.

Types of Credit

10% - The diversity of your credit is also important. Normally lenders find that borrowers with a good mix of credit may be of less of a risk for them. It helps to have a variety of different account types on your credit report, such as mortgage loans, credit cards and installment loans (auto loans – personal loans).

Credit Inquiries

10% -There are two types of credit inquiries: hard and soft. A soft inquiry is harmless to your credit score. A hard inquiry can lower your credit score. An example of a soft inquiry is when you check your credit yourself or if a potential employer views your credit for a background check. Don’t apply for credit with a lender just to have your credit score checked. There are many free ways to find out your credit score and what accounts appear on your credit report. Applying for a mortgage or a car loan will result in a hard inquiry. Since these inquiries are tied to your credit application, they are considered hard inquiries. New accounts, as well as new credit inquiries, can have an impact on your credit score. That being said, if you are rate-shopping, normally credit inquiries made within a 30-day time period won’t negatively affect your score.