Buying Timberland: Cash or Finance?

The Farm Credit Assocations of Georgia discuss the pros and cons of paying cash or financing your next big timber purchase.

Key Takeaways:

- Cash is king

- Rates are at an all-time low

- Farm Credit offers no prepayment penalities

- Save cash for improvements

- Technology has made the financing process quicker

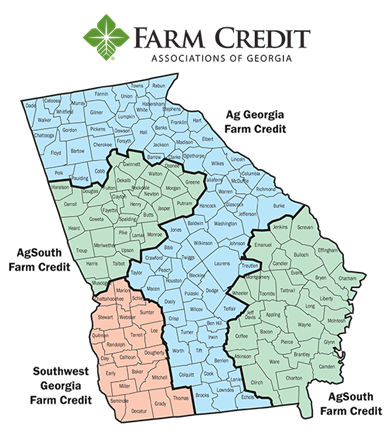

This article is sponsored by the Farm Credit Associations of Georgia in correlation with the American Forestry Conference. The Farm Credit Associations of Georgia are comprised of AgSouth Farm Credit, AgGeorgia Farm Credit, and Southwest Georgia Farm Credit.

Should You Pay Cash or Finance Your Timberland?

Timberland is one of the few assets that holds value, appreciates over time, and provides a tangible asset on which you can enjoy its benefits. Have you ever tried hunting, fishing or hiking on a stock certificate? The question isn’t, “Should I buy land?” The real question is, “How do I buy land?”

When purchasing timberland, there are two options to pay for the investment: Utilize an “all cash” approach or finance the property. Here are a few reasons why you should consider financing the investment, even if you have sufficient cash on hand to purchase the property.

Cash Is King: Maintaining Liquidity

In today’s uncertain times, you may prefer to keep cash on hand. Purchasing land requires a significant capital investment. Once the cash is spent, you lose your ability to act quickly on future needs and investment opportunities. The type of tract you are interested in may not sell often, so when it comes on the market you want to be ready to buy. The best way to invest wisely is to have the cash you need to pull the trigger quickly. Without liquidity, you could miss out on a good investment.

Rates Are At All-time Lows

With today’s low rate environment, you can achieve an interest rate that is at historical lows and oftentimes is below the return possible on the investment. For these reasons, more and more timberland investors are choosing to retain a liquid cash position which has the added benefit of allowing them to pursue additional transactions.

No Prepayment Penalties

One key difference between Farm Credit and other lenders is the widely available option of not having prepayment penalties. Coupling this with our low transaction costs, you should always explore whether financing provides a superior approach versus paying all cash. With no prepayment penalties, you can rest easy knowing there will be no further expense should you elect to pay off the debt early.

Save Cash for Improvements

If your plan is to build a cabin, barn, or pond, or make other significant improvements on the land after your purchase, be careful not to spend all your cash up front. Financing could make it easier for you to do more with your land because you have the cash on hand to do so.

Financing Speed Has Improved

Even though we mentioned that cash is king and you want to maintain liquidity to assure you are ready to quickly take advantage of opportunities, financing your purchase doesn’t mean that you will “lose out” on a tract of land. Thanks in part to digitalization and technological improvements, Farm Credit is able to close transactions within the 30-45 day time frame specified under purchase contracts, thus offsetting the notion that cash is always “faster.”

Questions?

The most important thing to remember when considering whether to pay cash or finance is that each person and situation is different. Do what you are comfortable with and what will allow you to best achieve your investment goals. Feel free to reach out to your local Farm Credit Associations of Georgia representative and they will be happy to discuss financing options with you.