The Best Answers to Your Construction to Permanent Loan Questions

Building your home can be stressful. Whether you already own your land or you want to buy land and build, AgSouth Mortgages can finance your land and construction and save you money with a one-time closing with our Construction to Permanent (C2P) Program. Below are answers to frequently asked questions regarding our C2P Programs.

Construction to Permanent (C2P) Frequently Asked Questions

What are some of the features of your Construction to Permanent Loan programs?

- Out in the country or within city limits. No limits on acreage.

- Fixed rate during construction. Lock in permanent rate within 60 days of completion.

- Up to 12 months of construction time

- Options for barndominiums, manufactured/modular homes, second homes, and homes exceeding the moderately priced dwelling limit.

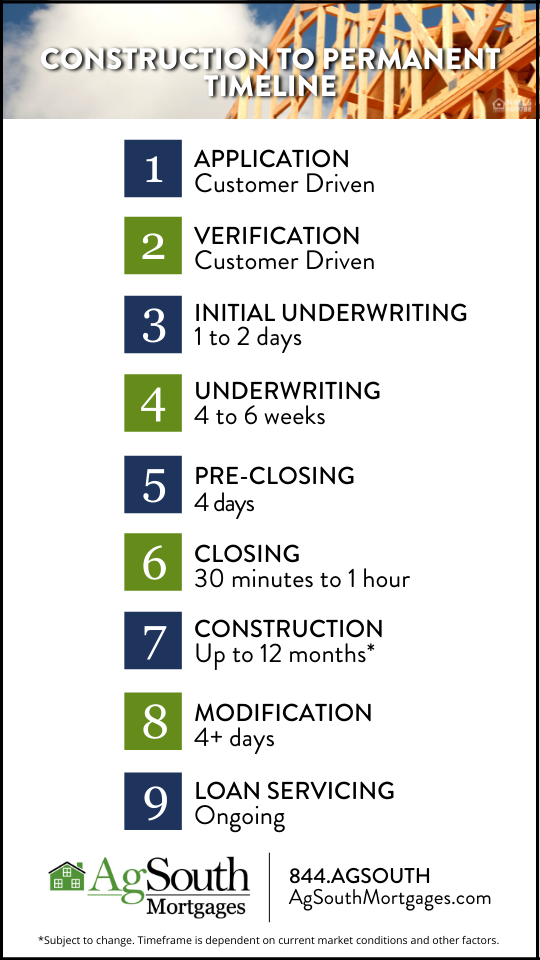

What is the C2P timeline?

The C2P timeline is longer than a normal home mortgage loan. This is because we have to verify and approve not only your information but your builder’s contract as well as review the construction plans and specifications. The time it takes to build your home will also vary based on a variety of factors including size of the home, builder availability, and market factors that might affect supply and demand.

Can I build my own house?

Self builds/owner general contractors are generally not allowed. Please discuss with your lender.

Does my builder have to be approved beforehand?

AgSouth does not require a builder to be “approved” but we do have a contract approval process, and we require them to be licensed in the state in which they are building. We will request documentation from the builder and review their builder’s license and confirm that they are in good standing in their state.

Can you finance construction of a barndominum, manufactured/modular, or log home?

Yes! We finance these homes under the same guidelines of a traditional stick built home.

Learn More: Curious on what real homeowners say about building their home? Check out our article Construction-to-Permanent Tips from Real Homeowners.

What can I include in my construction loan?

Almost anything the builder says they will build. Examples include pool, shops, wells, septic tanks, barns, etc.

What are my permanent mortgage term options?

We offer 15 or 30 year terms. This term cannot be changed at modification.

What if I’m self-employed?

Additional financials will be needed for self-employed borrowers. This includes: Copies of last two years’ personal tax returns (with all schedules signed and dated), copies of last two years corporate or partnership tax returns (with all schedules signed and dated, including K1’s), year to date current profit and loss statement (signed and dated).

What may I be responsible for out of pocket?

- Down payment (if you don’t own the land)

- Origination/lender charges

- Preferred attorney fees including title work

- Appraisal fee (this will be collected when your appraisal is ordered by a third party.)

- Homeowners insurance / builders risk insurance

- Flood Insurance (if applicable)

- Recording Fees

- Any property taxes due paid in full prior to modification Overage construction costs (if you exceed the cost of your build, you will have to provide proof of payment made in full to your builder prior to modification)

This is a general list of out of pocket expenses and may vary. Discuss with your lender.

What if my construction loan takes longer than 12 months?

If construction exceeds 12 months, your loan will be subject to requalification. We do offer a three-month extension at a fee. If the extension is exceeded, you must refinance your loan and pay closing costs again.

When do my payments start? Do I pay anything during construction?

Payments can start as early as 1 month after closing. As the builder takes more draws, your interest payment will increase. If we refinanced your land loan into your C2P loan, you will no longer have that separate payment since it will be included in your construction payment.